On first look, the early half of 2018 may seem like a broken record, with more of the same. No inventory and a high number of buyers. However, believe it or not, the real estate market is on a rollercoaster ride. It may be one of those kiddie rides at the fair, but nonetheless, there are some ups and downs taking place. In this mid-year market update, we’ll discuss the King County real estate market patterns through the first half of 2018.

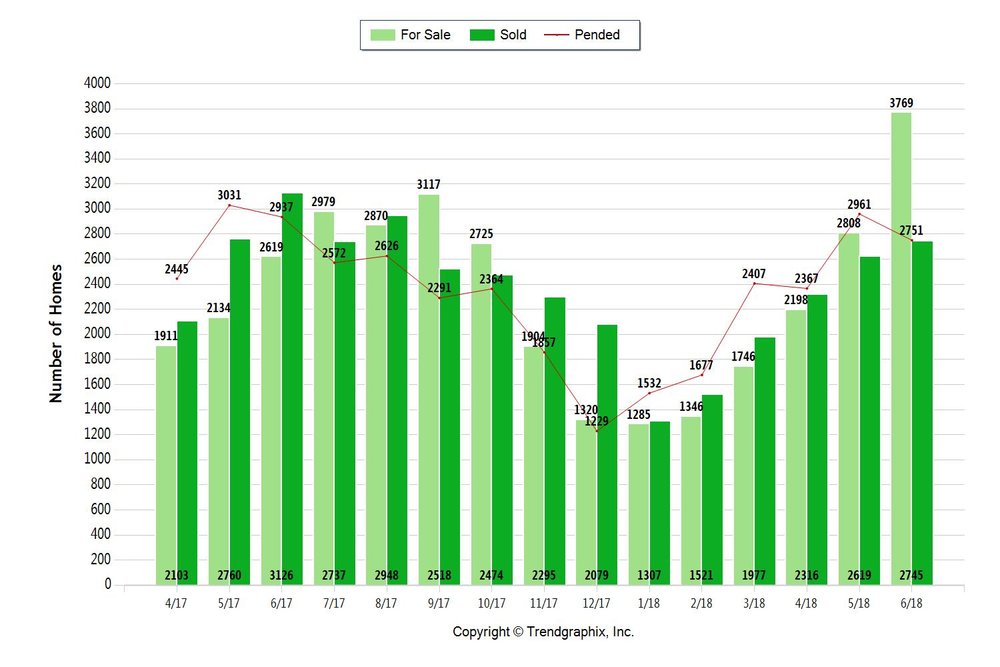

For what seems like forever, with each passing month, the number of sold listings has outpaced the number of new listings. The news reports that there is no inventory and the demand for houses increases as the supply decreases. However, by the end of May, the number of new listings had surpassed the solds. The increase in the number of listings is the biggest story of this mid-year report. There are 44% more listings than this time last year, and a 34% increase in the last month.

While the number of listings has increased, prices continue to rise. Overall, the price per square foot of King County solds are up 10% over last year. While a 10% increase sounds like a fair amount, the rise of listings has somewhat slowed down the rapid price increases of the last several years. Still staggering is the average sale price of those King County homes that are selling. Last year, the average sale price was $772,000. This year, that amount has risen to $864,000.

The average number of days on market is still very low. The number of days it takes to sell a King County listing is only 16 days. Considering that a lower priced King County home will sell in days and a million dollar home may last for months, this is actually a very low number. There is a correlation between low number of days on market and the average amount listings are selling above list price. Currently, homes are selling for 103% of their list price. That is, a $500,000 home could expect to sell for $515,000.

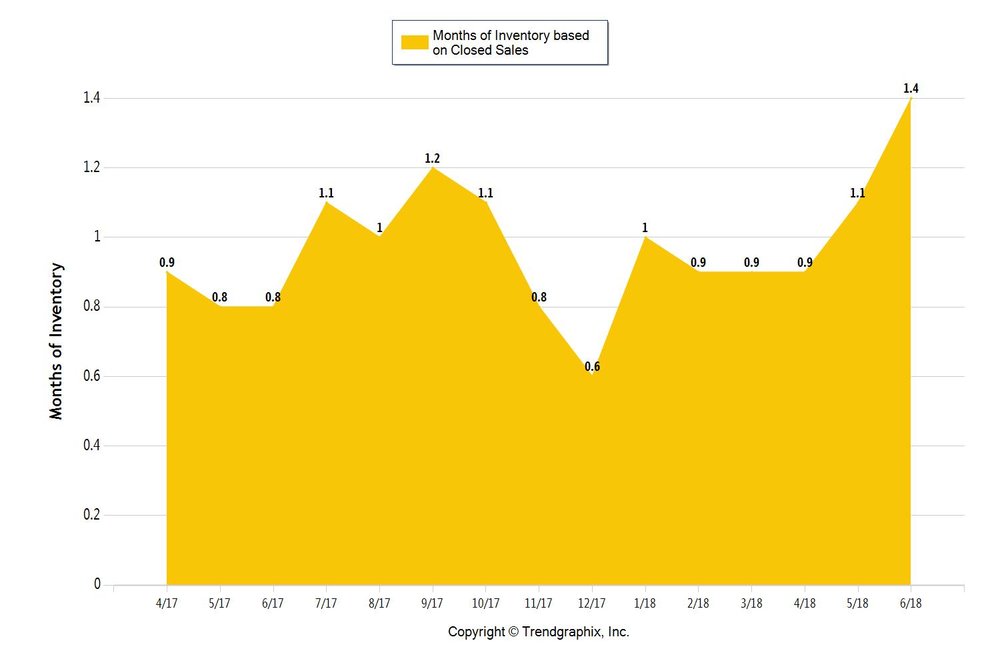

The absorption rate, also known as the months of inventory based on closed sales has increased to a 1.64 month supply. This is a whopping 72% increase when compared to the same month last year. Since anything under 4 months’ supply is considered a seller’s market, the market still doesn’t favor buyers. However, the increase in the number of listings has resulted in a longer market time. As a result, buyers now may be able to take a breath before making an offer.

As Bob Dylan sang, The Times They Are a Changing. With the number of new listings outpacing the number of listings closing, we are seeing a market shift. This doesn’t mean that the market is in trouble. Rather, the market is going through a normal pattern, which should occur. The leveling out of the market should slow down the rapid rise in price and lead to a more balanced market. Time will tell. While we may be headed to a market that is a far cry from what we have experienced over the last several years, this new market pattern may just turn out to be a relief from the thrill ride we’ve been on.

SOURCE: Coldwell Banker Bain Blog

+ show Comments

- Hide Comments

add a comment