For debt-laden and cash-strapped millennials, the stock market, despite historically superior returns, isn’t nearly as attractive as it is to other generations.

Instead, the younger set is all about the benjamins.

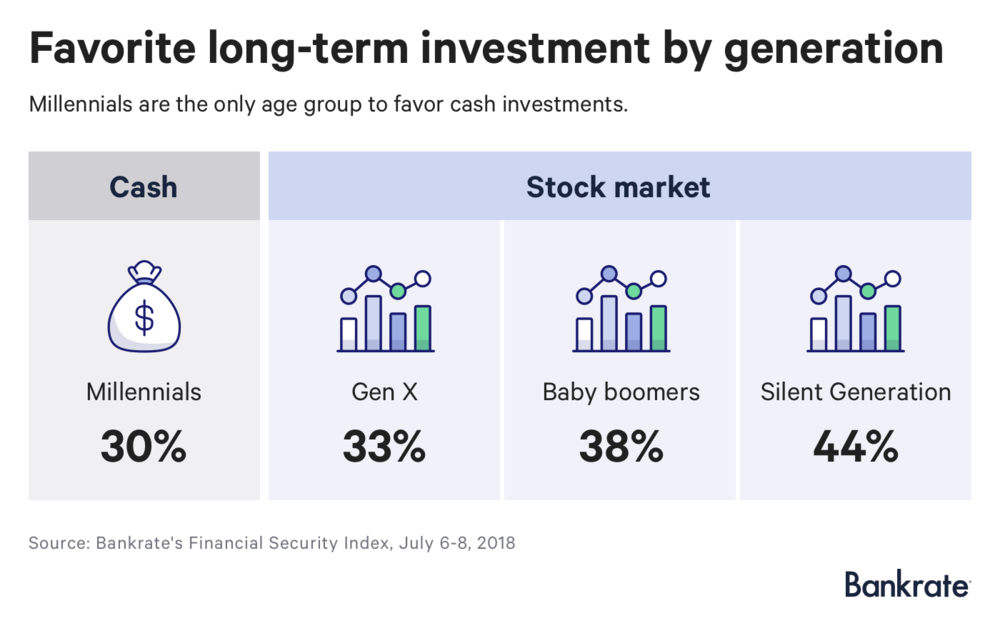

According to a survey from Bankrate.com, 30% of millennials say cash is their top long-term investment, while each successive generation claim stocks — a third of Gen Xers, 38% of baby boomers and 44% of the Silent Generation.

Overall, a third of Americans say the stock market is the best investment for money they won’t need for a decade. Less than a quarter say cash is tops.

Read: Millennials wonder whether it’s finally time to buy stocks

Greg McBride, Bankrate chief financial analyst, points out the folly in the cash approach. “For investment horizons of longer than 10 years, the stock market is an entirely appropriate investment,” he said. “Cash is not, and especially if you’re not seeking out the most competitive returns.”

Bankrate offered up a simple example as to why cash is not king in the long term. Take a 22-year-old planning to retire at 67 and saving $5,000 a year. He’d end up with an estimated $359,000 if he were to leave it in cash instruments at 2%, whereas if he’d have contributed to a balanced fund like Vanguard Wellington VWENX, +0.48% , he’d approach $2 million in his account (assuming the fund’s 8% annual return over the past 15 years).

Naturally, the more he invests, the bigger the difference.

So why the love for cash? Perhaps millennials, despite this long-lasting bull market, are still reeling from the 2008-2009 financial crisis, even 10 years out. Or, as Bankrate puts it, maybe it’s simply because they don’t have much of it.

The numbers show millennials are struggling with student debt and nosebleed housing costs. According to the Fed, households led by those under the age of 35 have only a median of $2,600 saved, while 41% have none at all.

To them, cash has to sound pretty attractive.

SOURCE: Marketwatch.com

+ show Comments

- Hide Comments

add a comment